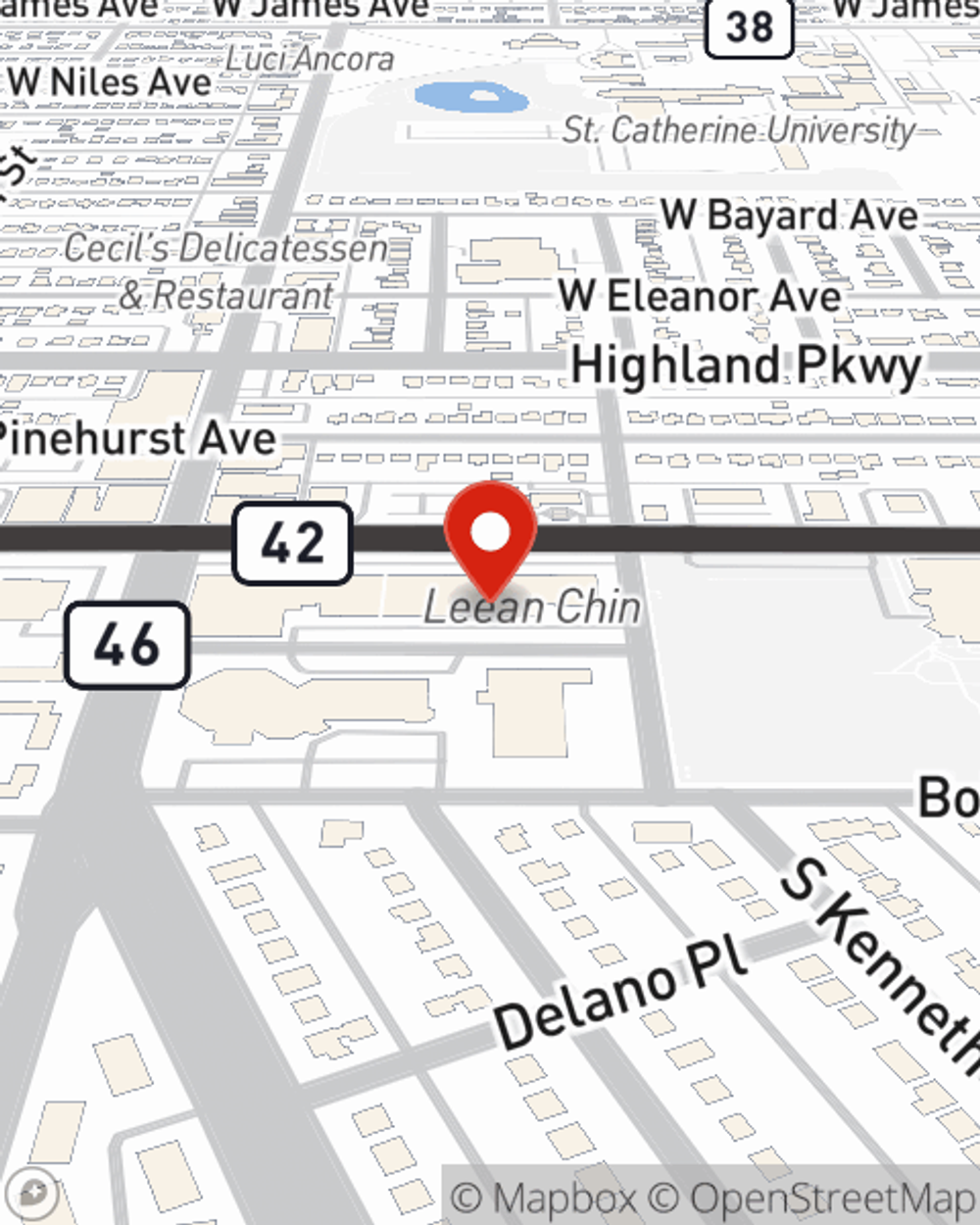

Business Insurance in and around Saint Paul

One of Saint Paul’s top choices for small business insurance.

Insure your business, intentionally

This Coverage Is Worth It.

Whether you own a a tailoring service, a bakery, or a hearing aid store, State Farm has small business insurance that can help. That way, amid all the different decisions and options, you can focus on navigating the ups and downs of being a business owner.

One of Saint Paul’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Future With State Farm

When one is as passionate about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, commercial liability umbrella policies, worker’s compensation, and more.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Chad Babcock's office today to discover your options and get started!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Chad Babcock

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.